Creating a budget for a commercial property with NNN leases can be a challenge, even for most experienced property managers.

This is a process that is usually done over couple of months and requires input from various professionals such as: property manager, leasing, accounting, asset manager, owners.

As a first step in this process, a good practice is for the property manager to have an initial meeting with the landlord or asset manager and discuss high level strategy items about the property:

1) Business strategy (is the property a short-term or long-term holding)

2) Capital projects planned for next year: analyze existing projects and amortizations, propose new projects based on the owner’s strategy for the building.

Prepare a list with all the building assets showing any relevant information that will help deciding about what projects are critical, such as: asset category, installation date, purchase price, estimated useful life.

.png)

3) Leasing assumptions: any vacancies, renewals, or new tenants, overall leasing market in the area, operating costs of other comparable properties.

These 3 major points will greatly impact the operating cost for the property.

Once the owner has agreed on these assumptions, the property manager can prepare the draft budget.

The next set of data that a property manager will need are the following expenses:

1) Property Taxes – tax consultants can provide fairly accurate estimates and annual expected increases

2) Insurance – this can be obtained from the insurance broker for the property

3) Utilities such as water, electricity, gas. The utilities agencies usually provide accurate estimates about any projected cost increases. When estimating the cost of utilities, you can analyze the actual consumptions/ usage from previous years for the building and then multiply those numbers with the projected cost per unit (KWh, cubic meter etc.)

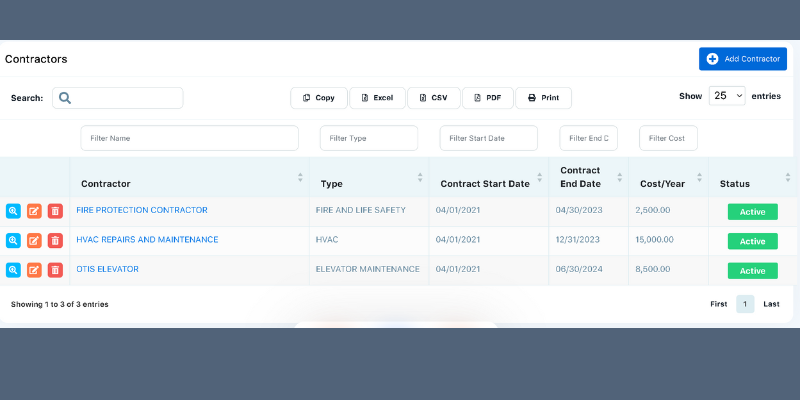

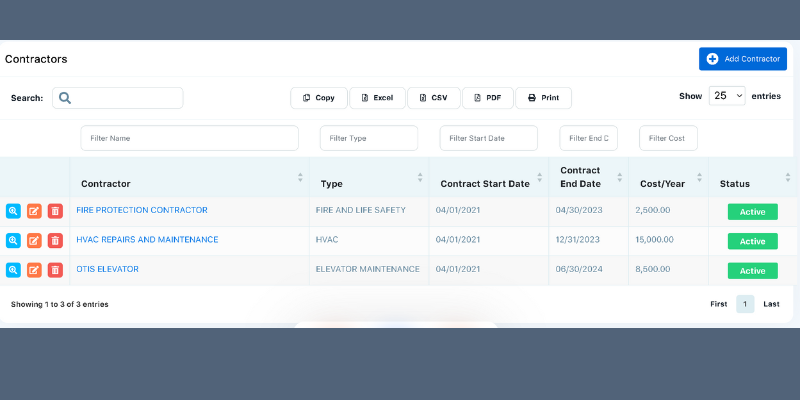

4) Service contracts for the building such as: security, HVAC janitorial, landscaping, roofing, elevator etc. Having all these contracts organized in a software will make the process smoother.

5) Salaries for building operations, management etc.

6) As a last step of a budget, you can estimate all the other non-recurring expenses based on historical data of the building and comparable cost for similar properties.

Good luck!

eProp Property Experts

Good luck!

Moving forward, together

(0) Comments:

Leave a Reply